Polymatech’s Future Plans And Benefits For Its Investors

The electronics and semiconductor industry in India has surged a lot in recent years but most of it is imported. India imports more electronics and semiconductors than crude oil and in a nation that is aspiring to capitalise on the growing electronic market, this is not good. That being said, the government of India has launched multiple campaigns like Make in India and Digital India to promote indigenous manufacturing of semiconductors and electronics. The current Semiconductor consumption in India is estimated to be around $24 billion and is expected to grow to a whopping $100 billion by 2025.

Now, India’s first semiconductor manufacturing company, Polymatech is all set to take semiconductor production to the next level by investing $1 billion into their business.

Introduction To Polymatech

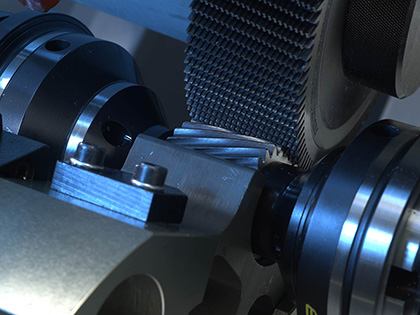

Polymatech is India’s first semiconductor manufacturing company and it was founded in 2007 by Eswara Rao Namdam. Since then Polymatech has emerged as one of the biggest semiconductor producers in the world and they aspire to become the biggest chip manufacturer in Asia by 2025. They have state-of-the-art manufacturing facilities with Japanese machinery located in Tamil Nadu. They manufacture microcontrollers, wireless chips, logic chips, memory chips, and LED chips. Polymatech aims to make semiconductor chips for lightning, medical and food sanitation applications. This will be a game changer for Indian economics as well as Indian investors. Let’s dive deep into the future plans of Polymatech and how it might benefit investors.

Polymatech’s $1 billion Investment

Polymatech is all set to become the leading semiconductor manufacturer in India. They have announced plans to invest $1 billion by 2025. This investment will promote the backward and forward integration of their current products as well as the indigenisation of several products that are now being imported. With an initial investment of $130 million, Polymatech has already signed an MoU with Tamil Nadu’s government. Their current manufacturing capacity is 1 million chips per day or 300 million per annum and they intend to take that number all the way up to 10 billion chips per annum. On top of that, they also plan to start a new plant and the plant will be running sooner than later. This investment is not only to boost the company’s semiconductor manufacturing capacity but also to make the raw materials at home.

According to the president of Polymatech, most of the raw material required to manufacture semiconductor chips is imported to India. So even after we are capable of making semiconductor chips, we are still dependent on imports for the raw material. He says that this will change too, as his company will manufacture components like silver paste and high-temperature co-fired ceramic substrates in India and cut their dependency on other imports.

How Will It Benefit Its Investors?

Polymatech is not a listed company but it does have shares in the grey market and they have been doing quite well lately. In December 2021, the price of their unlisted share was ₹200 and now in September 2023, the same share is worth ₹474, almost 2.5 times more than three years prior. This shows that the company has had constant growth since 2021. This is a piece of good news for investors as they can buy unlisted shares from the grey market today and after holding it for some time, sell it for a profit. Polymatech’s unlisted shares performance has been decent in the last few years and if the company keeps on doing what it has been doing, Polymatech unlisted share price might very well go through the roof. On top of that, the government of India announced a ₹76,000 crore package to incentivise investors and stakeholders to give a boost to the semiconductor industry. This means that your shares are also backed by the government which means that there is a very low chance of Polymatech’s unlisted share price going down.

Invest In Polymatech With Stockify

If investors are looking to buy unlisted shares, then Polymatech may be a very good pick. Its financials are good and Polymatech Electronics share prices have only gone up in recent years and with this new $1 billion deal it’s safe to say that Polymatech is a good investment.

The industry of semiconductors is something that is not going to die no matter what. Semiconductor chips are found in every single electronic appliance on earth, from your mobile phone to your laptop, desktop computer and everything in between.

Make sure that before buying unlisted shares you do your own research and if you have a problem finding data then you should visit Stockify. It gives you all the necessary information about the company and its unlisted share prices. Stockify is a trusted online trading platform that provides you with financial reports, brokers’ advice and an easy interface for trading. Contact expert brokers today.