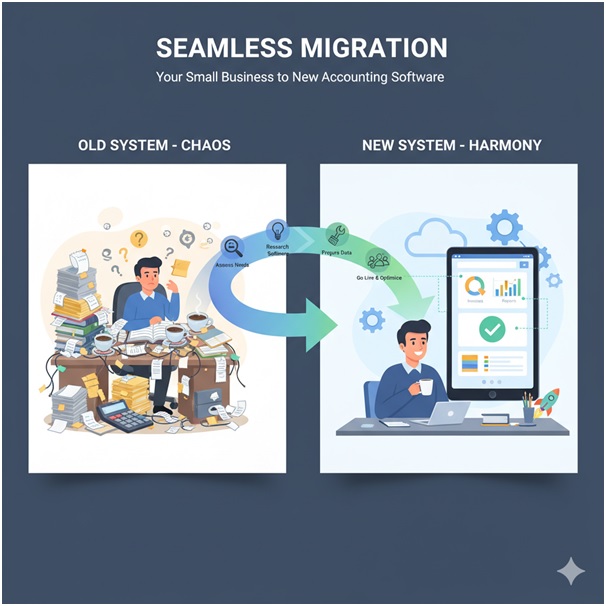

Converting to accounting software can be overwhelming to a small business owner – especially when accounting information, customer invoices, and records of spending constitute the main staple of everyday business.

Nonetheless, using an appropriate plan and instruments, the migration procedure to a new system can turn out to be the chance to refine procedures, eradicate inefficiencies, and upgrade financial administration. We shall accompany you stepwise, by questions and answers, into a new way of doing things.

What are the Reasons to Migrate to a New Accounting software?

Migration is required when your existing system does not match your business and its development, or does not have the option, such as automation, access to the cloud, integration with sales and inventory systems, etc.

Recent accounting programs like QuickBooks Online, Xero, or ZohoBooks provide live analytics, intelligent dashboards, and automatic reporting. One can take help from Kindle Scribe templates that one can use for keeping track of the software.

These assist business people in crafting informed financial decisions through data reduction and also reduce manual error. Scalability and financial transparency are guaranteed at the point of upgrade since your business is growing.

What are the Things You Should Assess before commencing the Migration?

Prior to transitioning, evaluate your existing accounting infrastructure – your chart of accounts, accuracy of data, level of access, and integration points. Discuss what data has to be moved (e.g., vendor information, invoices, expense types) and what could be stored in archives.

Develop a migration checklist or work with a template to plan the main information, such as schedules, tasks, and tests. This allows the migration process to be kept within a reasonable level of clarity and accountability.

What is the Best Accounting Software to Use in the Business?

Your perfect accounting software must align with the size of your business, industry requirements, and budget. As an example, service-oriented companies might find Xero as the preferred tool to track projects, whereas retail enterprises might use QuickBooks to manage the inventory.

Find the software that would be compatible with your current CRM, payroll, and e-commerce solutions. It is also prudent to use a couple of demos/free trials to gauge user-friendliness and how they respond to your business templates, e.g., invoice templates or expense trackers.

How do you prepare the best to migrate your data?

Before the migration, preparation is vital to prevent complications in the future. Begin with purging your data – delete any duplicate records, old entries on vendors, or misplaced costs. Normalize data formatting through spreadsheet templates (such as Google Sheets or Excel) and the requirements of the new software for importing the formatted data.

Templates can make mapping fields (such as Customer Name or Transactions ID) easy and can assist you in being consistent across your accounts. It can also help to maintain a monthly budget for the business.

What are the ways Templates can facilitate the process of migration?

Templates are set plans that assist entrepreneurs in following and authenticating financial data. You can use:

- Migration templates to follow the progress.

- Templates of expenses and invoices so that the data is accurate.

- Forms of inventory monitoring to match stocks and product numbering.

These standard patterns are ready to assist in maintaining an orderly system of transferring information and ensuring that nothing is left out in the process.

With the help of the right digital tools, financial management can be easier and smarter, which enables entrepreneurship to concentrate more on the things that are important to them most, which is to expand a business with a sense of confidence.